U.S. Corporate Debt

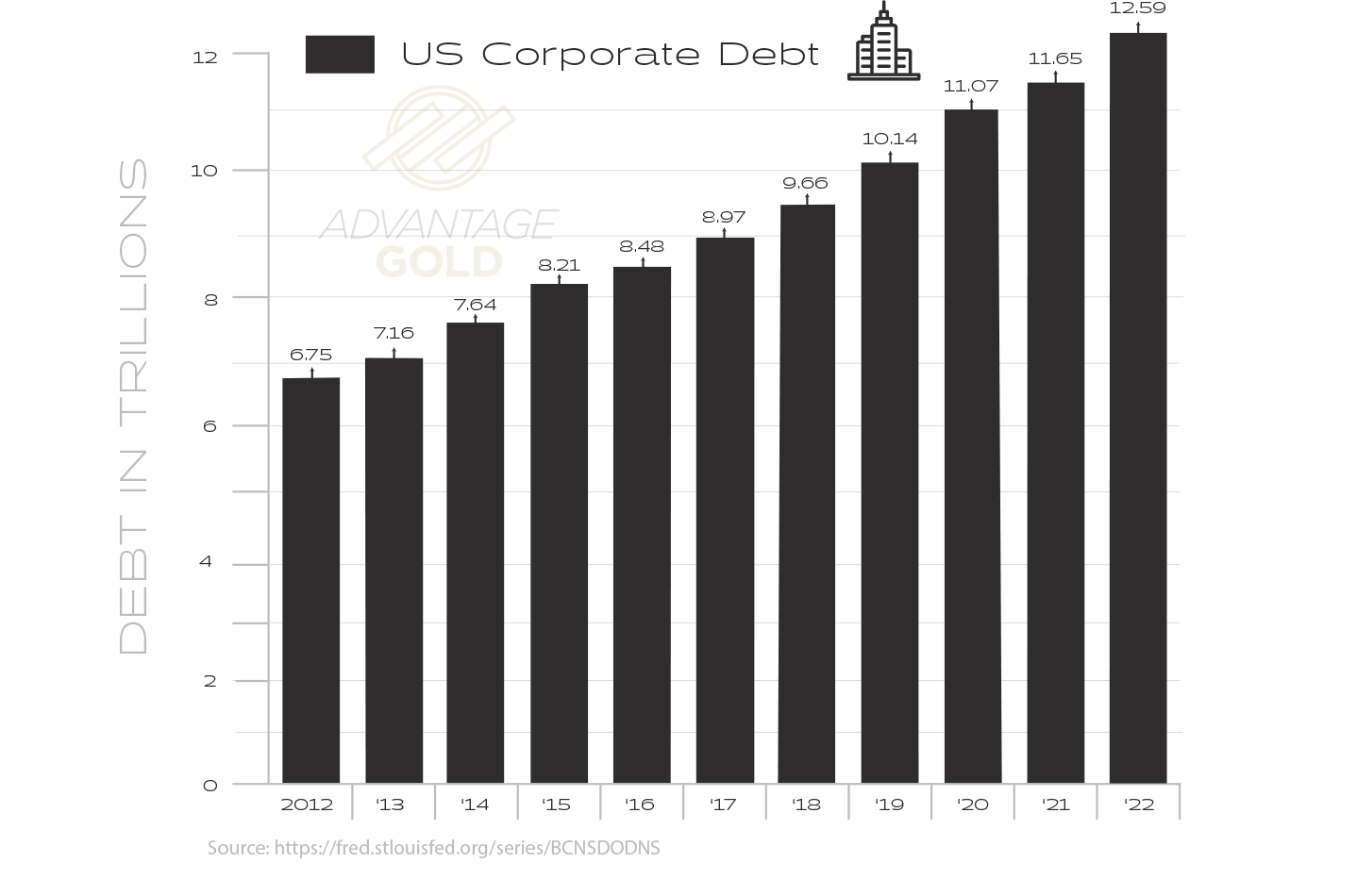

Over the last decade, the corporate debt market in the United States has grown significantly, with total outstanding debt surpassing pre-financial crisis levels. According to data from the Securities Industry and Financial Markets Association, the total amount of outstanding corporate debt in the United States stood at $11.1 trillion in 2021, compared to $6.7 trillion in 2010. This growth has been driven in part by low-interest rates, which have encouraged companies to borrow money to finance investments and acquisitions. However, the increase in corporate debt has also raised concerns about the ability of companies to manage their debt loads in the event of an economic downturn. This is particularly true for companies with lower credit ratings, which have accounted for a growing share of the corporate debt market in recent years. While low-interest rates have provided a boost to the economy, there are concerns that the buildup of corporate debt could pose risks to financial stability in the future.