- Home

- Tools & Resources

- 6 Powerful Charts

Retirement Protection Resources

Advantage Gold is committed to providing you with the education, understanding, and comfort you need to make sound financial decisions.

6 Reasons to Invest in Precious Metals

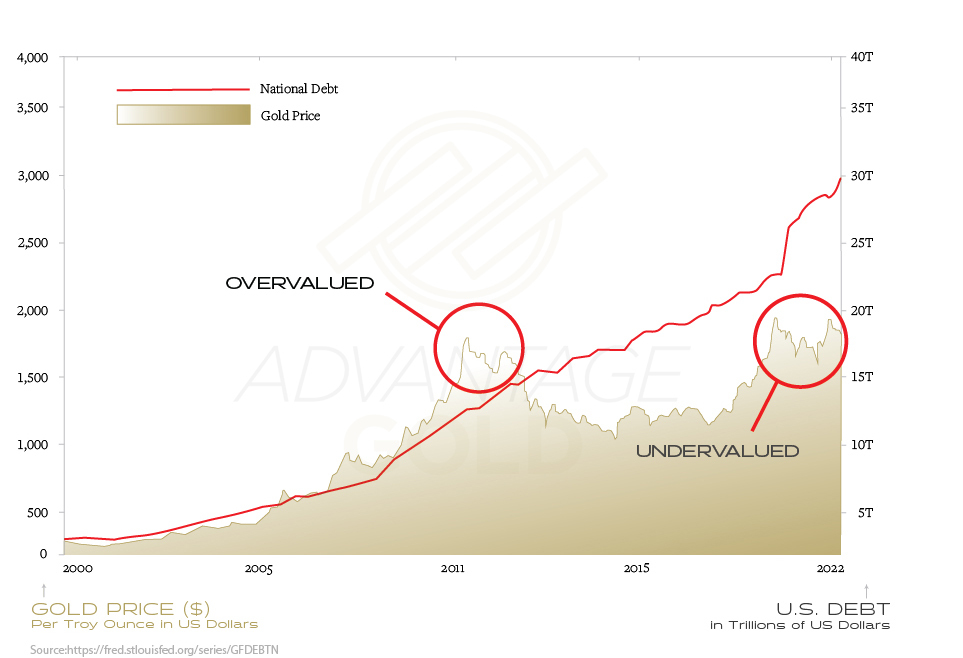

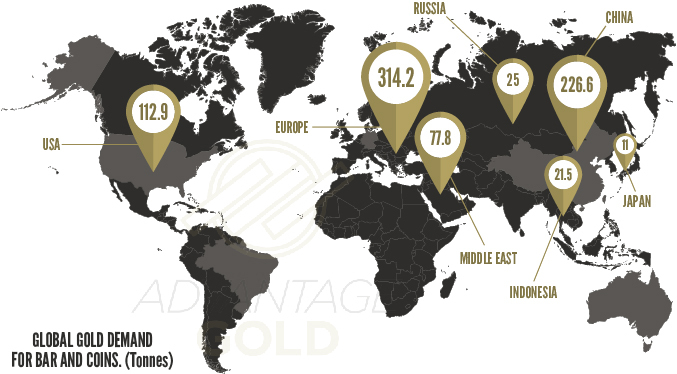

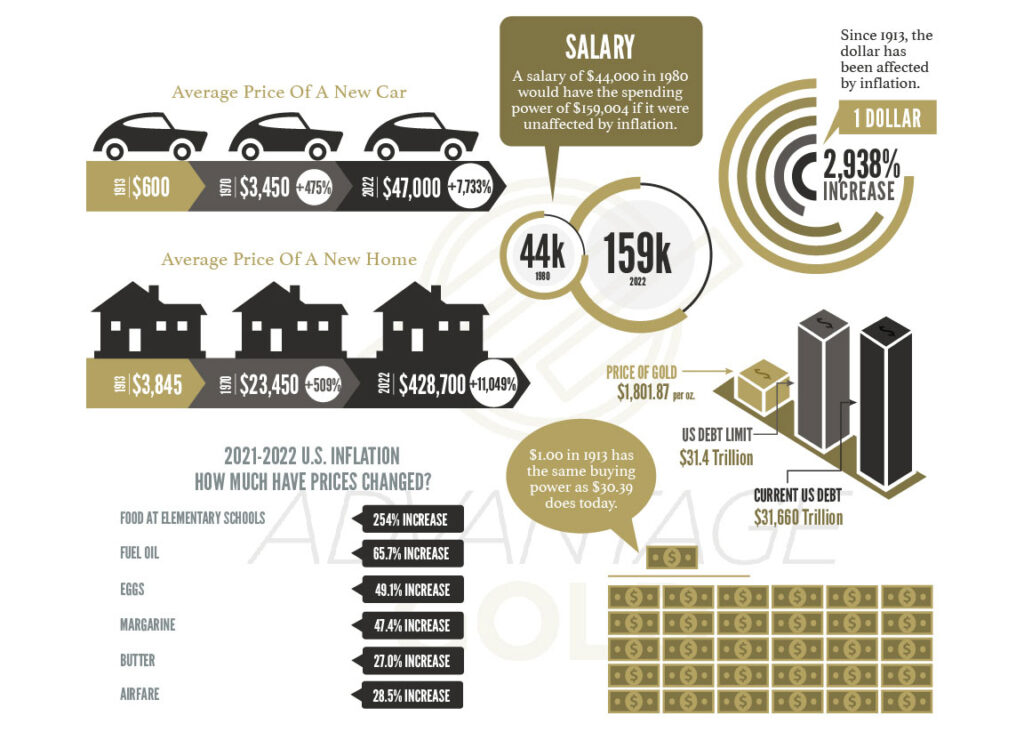

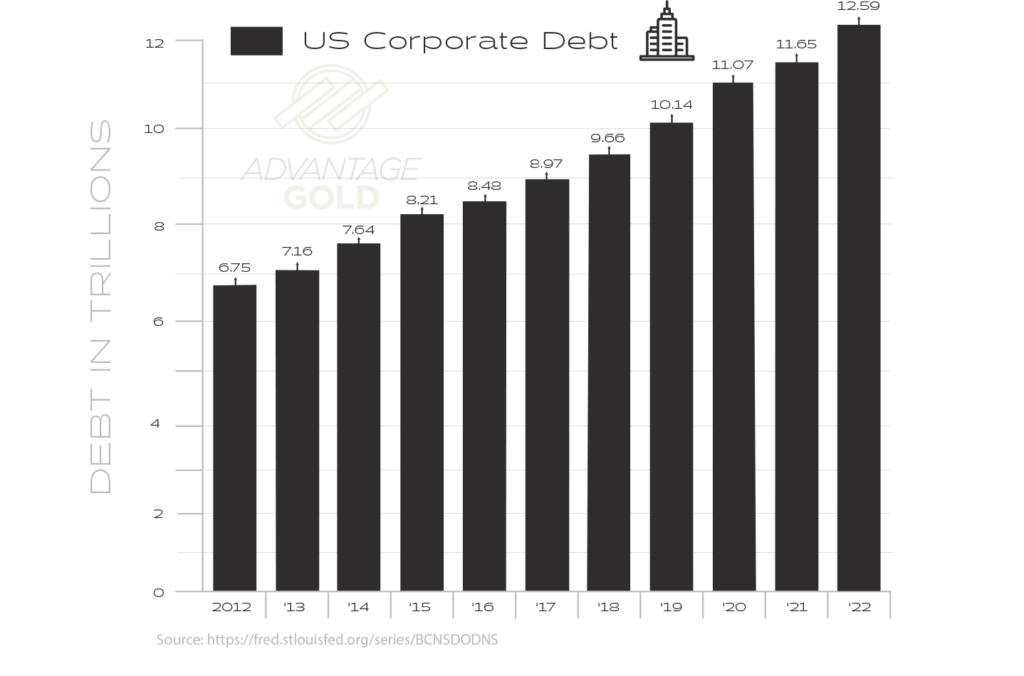

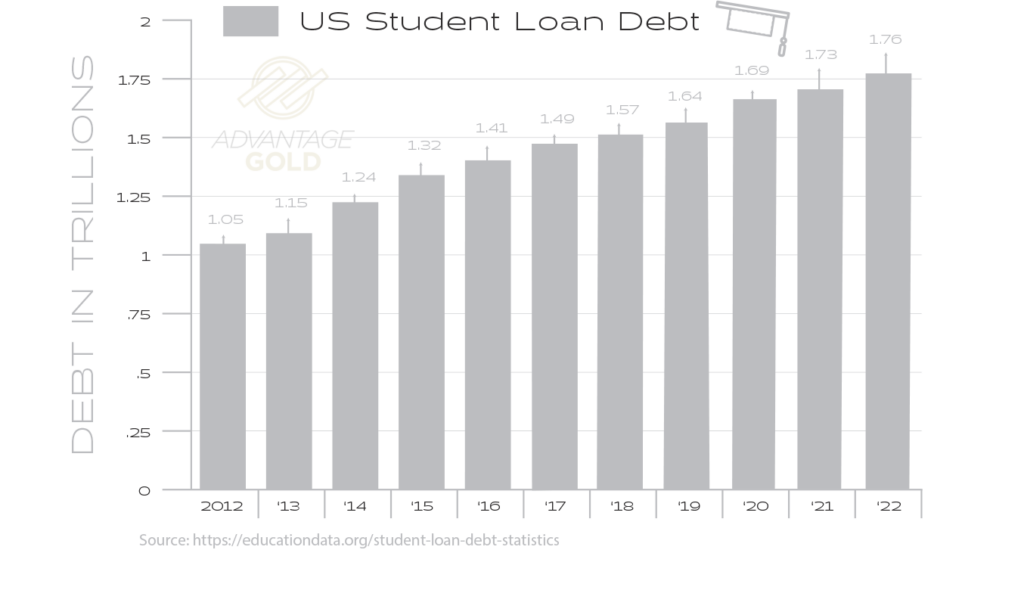

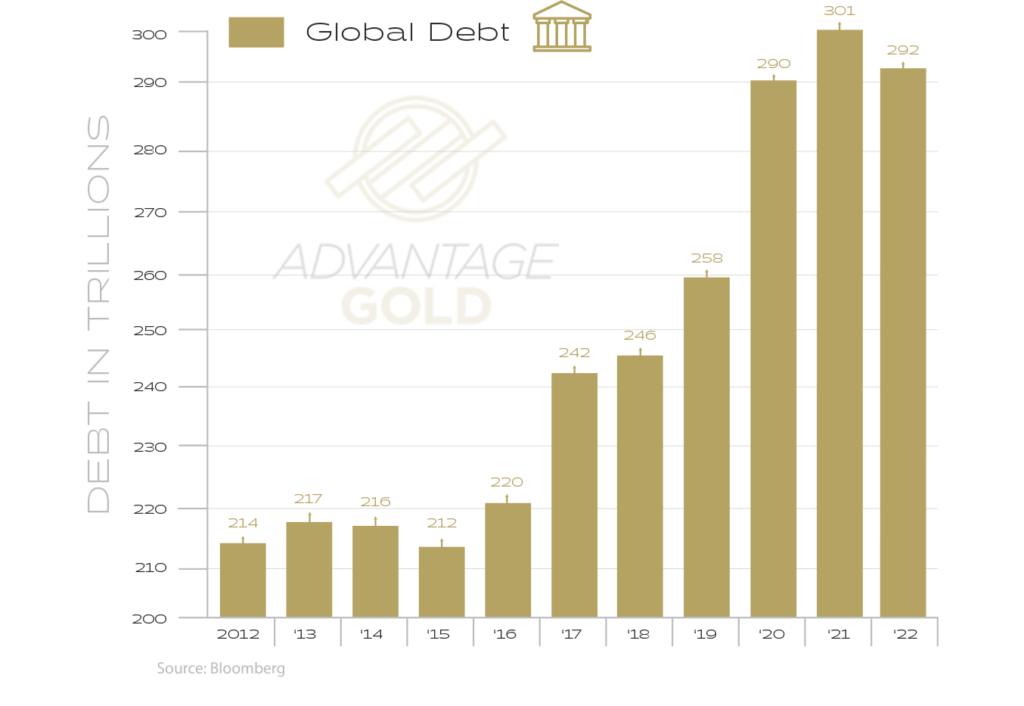

Advantage Gold is committed to providing you with the education, understanding, and comfort you need to make sound financial decisions. Here are some of our charts and graphs to help you learn about Gold and why you should choose Advantage Gold for converting your existing IRA or eligible 401(K) into a gold IRA or other precious metals IRA.

Get your FREE Gold Investment Guide Today!